Check security measures are used by banks and check designers so that it becomes at least difficult if not impossible for thieves to use your checks fraudulently.

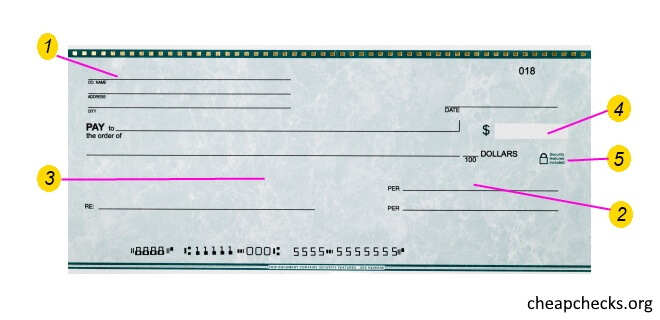

One of the obvious inclusions on a check is a person's (1) name, address and possibly a phone number. While that information does not necessarily subject a person to fraud, it is important information. What may happen, however, is that a thief may use that information to gather more data about you. It is generally recommended to keep the amount of personal information printed on a check to the minimum possible.

If you become familiar with the check security measures that have been used on your behalf, you will feel more secure the next time you have to write a check at the grocery store. Even cheap checks will have multiple measures in place. If you take a magnifying glass and look at your check, you will notice that the (2) signature line where you sign your name is actually words repeated over and over. It is not just a line of ink, it is a line of words that are extremely small. This makes it more difficult for the checks to be copied. If you look closely at the check you can see that there are (3) words faintly printed in the paper itself. This is an additional safeguard against your checks being copied. Special security measures in check printing mean that if a check is photocopied the copy will show telltale marks. These can be readily spotted by a bank or other financial institution.

If you have ever written a check to someone you did not know, perhaps you were afraid that the person might change the (4) amount you wrote on the check and just cash it for a higher amount. With the new check security measures that is virtually impossible. The paper that is used causes a white mark if an eraser is used to try to change the numbers. A bank teller knows what to look for and will notify managers.

On the line where the amount of the check is written, there is a (5) small padlock icon that tells you that the checks are designed in such a way to protect you from anyone else using the checks or changing them in any way. If you turn over a check there is generally an information box with security information provided. This is intended to reassure legitimate check users and deter check fraudsters.

If you want even more security you can obtain checks with holgrams on them. Holograms a difficult to reproduce without sophisticated equipment and therefore provide a higher level of security than a normal check.