Majority of Americans who have an existing checking account are not really quite aware about the different parts of a check. This means that either they are not fully aware or they just do not bother to find out what these parts are. Knowing the various parts actually can help checking account holders to properly read and understand how the bank checks are formatted.

Comprehending the individual parts can also be useful in ensuring that all transactions are properly completed. The various parts of bank checks that you need to be familiar with are:

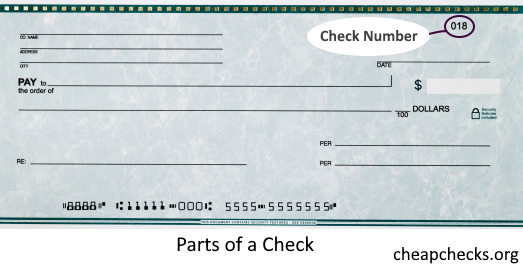

Check Number

This portion is placed on the bank check for easy identification. This part of the bank check normally appears on the top right portion of the check with some checks having another check number at the lower portion of the check. This number serves as a reference for the checking account holder to make it easier to keep track of the payments that have been made using bank checks.

Every time that a check is written, it should be recorded using the check number as the reference along with the date it was issued, the payee, and the exact amount to ensure that your balance is updated.

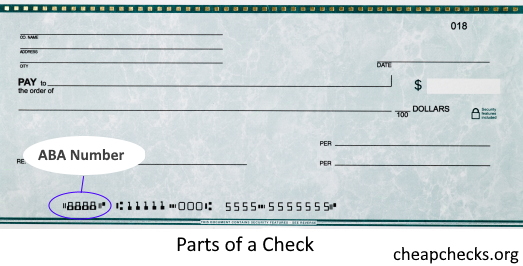

ABA Number

When deciphering the various parts of a check, it is important to be aware that the ABA (American Bankers Association) number is also sometimes referred to as the Fraction Code. This is because this number is commonly represented in fraction form and is located at the upper right corner of every check. The top portion or numerator of the fraction helps to identify the exact location and district of the bank where the funds are being drawn.

The bottom portion or denominator is used as a reference in routing the check to particular areas and the bank where it will be drawn. This represents an alternate way of denoting the 9-digit routing number that is associated with every checking account. When the MICR line part of the bank check is mutilated, this Fraction Code will be used as reference instead.

Account Holder Preprinted Information

For majority of banking institutions, the checks that they issue normally have preprinted information about the checking account holder. This portion of the bank check contains the name, address, and telephone number of the account holder and is normally positioned at the top left portion of every check. Usually majority of businesses would be reluctant to accept checks if this portion does not exist.

Sometimes account holders would opt for their email address to be included in this section which is also referred to as the Address Field. It is important to realize that among the various parts of a check, this portion reveals the most about the checking account holder, which means information, should be carefully screened. Normally, information like Social Security Number is prohibited from being included in this field.

Date Field

By practice, among the various parts of a check, this is the one that should be filled up first. It is important to write down the date first because it will dictate when the bank check becomes valid. When a future date is specified, it is categorized as a PDC or Post Dated Check, which means that it only becomes legitimate when the written date comes. The use of PDC is often discouraged because of the potential confusion when the date is overlooked.

However, majority of checking account holders use this practice to ensure that there are sufficient funds to cover the amount they have written. The down side is that most banks process checks upon presentation to them, which means that PDCs may incur a holding fee when submitted to the bank. Moreover, checks that are more than six months old are normally declared as stale and lose their value.

Payee Account

This portion of the bank check identifies who is the person or organization that will be legally allowed to receive the specified amount. This can serve as part of the protection mechanism of the financial transaction because only specific entities will be able to cash or deposit the bank check. In some instances the word “Cash” is placed in this part to allow anyone in possession of the check to redeem its value.

Numeric Amount

This portion of the bank check corresponds to the monetary value in dollars and cents (or whatever currency you are using) that the payee will receive. This portion should be clearly and neatly written and should be positioned as close as possible to the currency sign. Any erasures or modifications must be countersigned by the account holder. It is important to note that the amount should correspond to what is in the Written Amount field.

Written Amount

This is the word equivalent of the figure contained in the Numeric Amount field. Usually the word dollar (or whatever currency) has already been preprinted towards the end of the line. The word “and” replaces the decimal point to reflect the separation of the dollars and cents value. No space should be left to prevent any words from being inserted or the figures from being altered. The words should correspond to the figures of the amount written.

Bank Information

This part of the bank check shows the full name of the bank together with its branch, bank address, telephone number, city, state, and Zip code. There are times when the website as well as the email address of the bank where the checking account is held also appears in this part. This helps to facilitate identification of the exact branch where the account is being held.

Account Number

This is one of the most important parts of a check because it helps to identify the specific account within the banking system. Normally the account number is placed at the bottom of every check and placed to the right of the routing number. The account number is unique to every checking account holder of the bank.

Routing Transit Number (RTN)

This is a 9-digit number that references how the bank check will be routed. This is commonly placed to the left of the account number located at the bottom of every check. This portion is commonly called the MICR field and contains both the RTN and the Account Number. This code will ensure that the check is routed to the correct issuing bank. It is important that the RTN matches both the bank name as well as the Fraction Code to ensure that direct deposit will work.

Memo Field

This portion of the bank check is near the bottom left of the bank check and is commonly reserved to specify the purpose for which the amount is being drawn. This is an optional field and therefore can be left blank. The field is never read by the bank and will not affect the check processing. Its sole purpose is to remind the checking account holder what the money was spent for.

Signature Line

This part of the bank check usually has the name of the drawer or account holder preprinted. The checking account holder simply has to sign over his name to signify that the contents are true and correct. Banks have a copy on file of the signature of all their checking account holders so that they can confirm whether it is valid or not. It also helps prevent fraud and forgery of the bank account.

Because the signature gives the holding bank the permission to authorize payment of the stated amount, among the parts of a check, this should be the last portion to complete.

The Check Background

This part of the check is the extra part that you don’t think of. It may contain special security features, a personalized custom photo or just a clean blue or parchment pattern. In some ways it is the most noticeable area of a check and can be themed to match a business or a personal interest.