Learning how to write a check is essential for when you finally open a checking account. Used to pay for goods, services, and many other things in your life, knowing how to write one up properly can also save you valuable time and money.

Write one up the wrong way, and you might end up at the bank trying to straighten out a discrepancy or explaining a bounced check. It’s up to you to make sure your personal checks don’t end up this way.

Mastering art of writing up a check will help you get through many of your financial debacles with ease. If you have never written a check before in your entire life, then this guide will give you the whole play by play along with useful tips to keep in mind when you’ve finally learned how.

You’ll end up writing one cleanly, legibly, and maybe even a way that will prevent your checks from being duplicated by scammers.

Let’s Write Up That Check

Provided you have already opened up your checking account and have gotten an accompanying checkbook, it’s time for you to learn how to put them to good use. If you don’t already know how to write your checks, or need a short refresher course to help you write them better, then you should definitely read on to these handy steps:

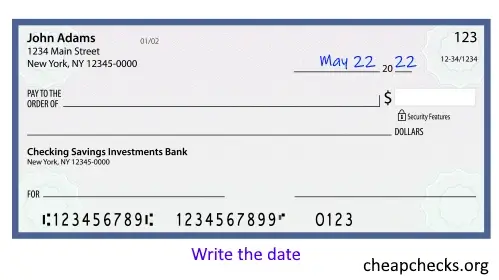

Start by writing down the date of your check. This field is usually placed on the top right part of your check. If it’s a post-dated check, then write the date at which the check may be cashed out.

The recipient’s name should be written next. You will write it on the field that reads “Pay to the order of” If you are writing the check for a business or organization, then write down its full name. Don’t write acronyms or abbreviated names. unless you have made sure that it’s OK.

Fill out the box where it states that you must write up the numerical value of the check. For example, if you want the check to be valued at four hundred twenty dollars and sixty-nine cents, then write the value as $420.69. You can strike out the remaining blank space on the field with a line in order to prevent tampering.

The next field you can fill out is the worded value of the check. Again, if you are writing your check to be valued at $420.69, then write it up as such: four hundred twenty dollars and sixty-nine cents.

Sign the check on the bottom field that states such. Your check will not be valid for cashing in or depositing if your personal signature is not on it. Some checks can have your full name pre-printed on the check, so that you do not have to manually write your print name under your signature anymore.

Some checks will have a small area on a lower corner that says “memo.” Here, the check writer can write the purpose of the check. For example, fill this area with “bills” or something of similar effect if you are indeed writing the check to pay for a bill.

Tips and Tricks

People who have experience writing checks might tell you that there is a certain way of writing them that can make then extra-special to the people or organizations receiving them. If they don’t make you especially wonderful of your check recipients, then they should make the check appear more professionally done, at the very least.

Try these out next time you have to write a check:

Practice your handwriting! Good, legible penmanship goes a long way with your check recipients, especially if you are writing business checks or in a more professional setting.

Sign your name the same way every time; some banks will invalidate a check if they think your signature looks off, even if you were really the one who signed it.

Don’t forget to log the check in your transaction register. Balancing out your checkbook will make sure your checks don’t end up balancing because you forgot your account’s spending limits.

Post-dated checks can still be deposited into bank accounts, despite having a different date written right on the check. Don’t let people fool you into “holding on to the check” and promising you outright lies.

Doubled checkbooks will record a carbon copy of any check you write out. This can be good if you would like easier reference to your checkbooks than your transaction register; how often do you make a mistake logging in your checks, anyway?

If you make a mistake when writing a check, cross out the entire space of the check with a few lines and write “void” on it. This is to prevent people from fraudulently using the check.

If it makes you feel even better, then tear up the check thoroughly so that people will not be able to write up a check for themselves on your dime, or copy the MICR code on it.

Most of all, be sure to spend wisely! Having a checkbook can excite people who have never had them before, so don’t let your spending habits get the best of you.

After learning the tricks of the trade, you will already have learned well by now. Knowing how to write a check is essential, and can even be fun to learn at the same time!